I. This week’s market review

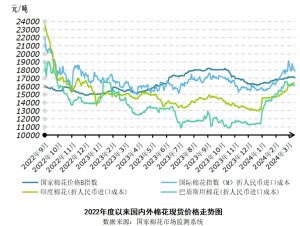

In the spot market, the spot price of cotton at home and abroad fell, and the price of imported yarn was higher than that of internal yarn. In the futures market, the price of American cotton fell more than Zheng cotton in a week. From March 11 to 15, the average price of the national cotton price B index, which represents the market price of mainland standard grade lint, was 17,101 yuan/ton, down 43 yuan/ton from the previous week, or 0.3%; The average price of the International Cotton Index (M) representing the average landed price of imported cotton in China’s main port was 104.43 cents/pound, down 1.01 cents/pound, or 1.0% from the previous week, and the import cost of RMB 18,003 yuan/ton (calculated by 1% tariff, excluding Hong Kong impurities and freight), down 173 yuan/ton, or 1.0% from the previous week. The average settlement price of the main contract of cotton futures is 15,981 yuan/ton, down 71 yuan/ton from the previous week, down 0.4%; New York cotton futures main contract settlement average 94.52 cents/pound, down 1.21 cents/pound from the previous week, or 1.3%; Conventional yarn 24,471 yuan/ton, 46 yuan/ton higher than the previous week, higher than domestic yarn 1086 yuan/ton; Polyester staple fiber prices rose 12 yuan/ton to 7313 yuan/ton.

Second, future market outlook

The current resistance to rising cotton prices mainly comes from the following aspects: first, cotton prices have experienced a rapid rise after a correction, textile enterprises wait-and-see psychology is strong, and the willingness to buy cotton is reduced; Second, with the approach of 2024 cotton spring sowing, the direction of cotton prices is to be guided by the change of cotton planting intention in major countries; Third, the US presidential election in 2024 is gradually unfolding, and its impact on US domestic financial policies and trade policies is difficult to predict, and enterprises have to be cautious about it. Fourth, according to Xinhua news, Houthi armed leaders claimed that the scope of the attack on the ships “associated with Israel” has expanded from the Red Sea to the Indian Ocean and the Cape of Good Hope. It is expected that the rising transport costs of Asia-Europe routes will lead to the difficult decline of inflation in Europe and the United States, and continued high interest rates will lead to shrinking market demand in Europe and the United States.

The current support force for cotton prices mainly includes the following aspects: first, China’s recent exports to the United States, ASEAN and other major economies have rebounded, and textile enterprises are expected to “Jinsan silver four”; Second, with the recent strengthening of international crude oil prices, the price of polyester staple fiber, the main substitute for cotton fiber, has risen; Third, since February, the Baltic Sea shipping index has continued to rise, with a cumulative increase of 69.31%, reflecting the recovery of international trade; Fourth, Australia cancelled import tariffs on some commodities, including pajamas, sanitary products and other categories, which helped to stimulate the demand for cotton to a certain extent; Fifth, considering that the expansion of the scope of the Red Sea conflict will seriously affect the transportation time of Asia-Europe routes, it is expected that the probability of European orders shifting from Southeast Asian countries to China is greater, which will also lead to cotton consumption shifting from Southeast Asian countries to China.

In summary, cotton prices are difficult to trend changes in the near future, and the probability of continuing to maintain shock finishing is large.

HEALTHSMILE MEDICAL always pays attention to the price and quality of cotton at domestic and abroad, adheres to the global procurement of high-quality raw materials, and continues to provide customers with high-quality pure cotton products.

Post time: Mar-17-2024